烟台鄂破机-矿石破碎设备

鄂式破碎机,鄂破机,烟台鑫海是专业生产鄂式破碎机厂家

烟台鑫海鄂式破碎机广泛运用于矿山、冶炼、建材、公路、铁路、水利和化学工业等众多部门,破碎抗压强度不超过320兆帕的各种物料的破碎工作。 鄂式破碎机——工作原理 鄂式

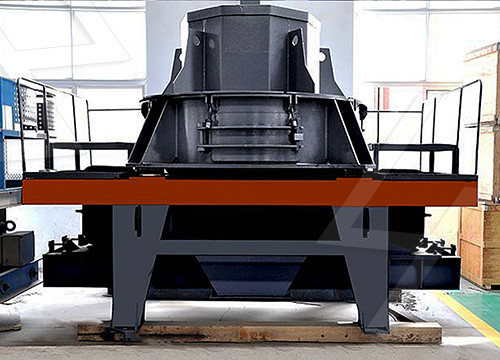

产品展示,烟台槽式给矿机,颚式破碎机-烟台大成矿山机械

2022年9月2日 给矿设备 破碎设备 筛分设备 运输设备 磨矿设备 分级设备 浮选设备 重选设备 浓密设备 过滤设备 黄金氰化专用设备 提升设备 砂泵 XAZ、XMZ系列圈自动压滤机

鄂式破碎机颚板 配件及耗材 烟台金鹏矿业机械有限公司

鄂式破碎机式破碎机的工作部分是两块颚板,一是固定颚板(定颚),垂直(或上端略外倾)固定在机体壁上,另一是活动颚板(动颚),位置倾斜,与固定颚板形成上大下小

鄂式破碎机专破各种中硬矿石和岩石,原来是有这个特点

2021年6月23日 颚式破碎机是根据砂石骨料市场情况、客户需要,设计的一款新型智能、环保节能碎石设备,非常适合用于固定式破碎生产和移动破碎站。颚式破碎机为大型复摆

矿石破碎机-批发价格-优质货源-百度爱采购

2023年7月26日 小型对辊式破碎机设备 破碎各种矿石的新型对辊机 液压双辊制砂机 电机驱动 小型 巩义市华盛铭重工机械厂 4年 00:34 查看详情 花岗岩颚式破碎机 鄂破机厂家 细碎颚破200x300 博之鑫矿石鄂式破碎机 细碎式鄂破碎机 粗碎机 细碎 郑州博之鑫机械

不同破碎方式的破碎机有何优缺点? 知乎

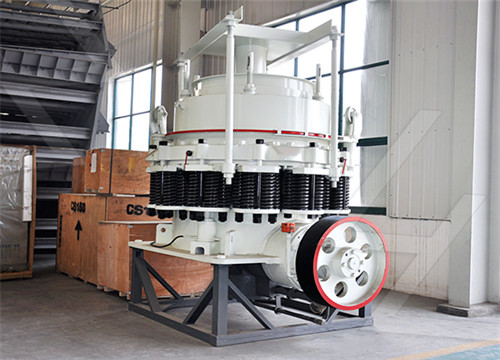

2021年8月16日 其他击打式破碎机在这里不多做介绍。3、层压式破碎机:圆锥破 圆锥破也是一款二次破碎设备,用于破碎中等和中等以上硬度(350兆帕以下)的各种矿石和岩石,如方解石、石灰石、花岗岩、河卵石、白云石、青石等。

颚式破碎机 百度百科

2021年1月26日 颚式破碎机俗称颚破,又名老虎口。由动颚和静颚两块颚板组成破碎腔,模拟动物的两颚运动而完成物料破碎作业的破碎机。广泛运用于矿山冶炼、建材、公路、铁路、水利和化工等行业中各种矿石与大块

鄂破和锤破这5大区别,你竟还不知道! 知乎

2020年10月10日 鄂破和锤破是我们在破碎石料时较常见的破碎机种类,经常会有朋友打电话来问说想要单台锤破,不想用鄂破,能不能行?. 要弄清这个问题,首先我们要先了解鄂破和锤破的这5大区别。. 1.外观和工作原理不同. 了解这两种设备的朋友从外观上就能区分

看老外制作的,颚式破碎机破碎原理,动画演示~ 哔哩哔哩

2020年11月19日 看老外制作的,颚式破碎机破碎原理,动画演示~本视频由济宁智造工程智造大观发布!,视频播放量 3635、弹幕量 0、点赞数 27、投硬币枚数 4、收藏人数 44、转发人数 10, 视频作者 智造大观, 作者简介 济宁钛浩机械、济宁智造工程科技有限公司,滑移装载机、挖机属具等系列大全,你想要的

铁矿石破碎用鄂破还是圆锥破? 知乎

2020年12月1日 鄂破一般用于铁矿石破碎的一段破碎环节,适合将70-80公分的大块矿石破碎到20、30公分以下,具有破碎比大,耐磨损,能耗低等特点。 用于一段破碎的鄂破时产在50-1000多吨,有普通和欧版鄂破两种类型,多样的型号可以满足不同生产需求。

如何选择合适的破碎设备? 知乎

2020年5月18日 1.物料的硬度. 不同种类的物料具有不同的硬度,一般情况下,硬度越大,破碎难度系数越高。. 破碎硬质或中硬质石料,宜选用颚式破碎设备作为一级破碎设备,破碎中硬或软质石料时,可直接选用圆锥、反击或锤式破碎机。. 2.物料的规格 若物料规格尺寸

鄂式破碎机_节能环保型鄂式碎石机_PE/PEX系列

2022年5月15日 颚式破碎机种类齐全,按照先进程度由高到低依次为CJ欧版颚式破碎机、HD德版颚式破碎机、PE颚式破碎机和PEX细颚破四大系列,每小时产能在1-1590吨之间,细分为众多型号,选择不同系列型号的鄂破机,价格都是不同的,用户只有先根据自身实际情况

鄂式破碎机-鄂式粉碎机生产厂家-河南红星矿山机器有限公司

鄂式破碎机价格. 红星工程师认真检查每一台机器,对残次品0容忍. 鄂式破碎机出现时间较早,所以各厂家对其生产技术都已经较为成熟,可以有效的控制生产成本。. 红星机器专业生产鄂式破碎机40年,生产的鄂式破碎机质量可靠、性能优,价格实惠,欢迎新老

小型颚式破碎机的型号及价格,一小时的产能能达到多少吨?

2020年6月13日 小型鄂式破碎机常见型号和参数. 小型普通颚式破碎机;主要负责全套生产线的粗碎工作,常常作为生产线的一级破碎设备进料口大,破碎硬度大,其中应用较为广泛的是PE400×600 (也就是我们经常说的46鄂破)、PE500×750 (也就是我们经常说的57鄂破)、PE600×900(也

颚式破碎机 百度百科

颚式破碎机俗称颚破,又名老虎口。由动颚和静颚两块颚板组成破碎腔,模拟动物的两颚运动而完成物料破碎作业的破碎机。广泛运用于矿山冶炼、建材、公路、铁路、水利和化工等行业中各种矿石与大块物料的破碎。被

鄂式破石机-鄂式破石机价格、图片、排行 阿里巴巴

公路水泥块硬岩石破石机 工业打青红石设备 锂矿石细鄂式破碎机 鼎仕达 品牌 一件代发 ¥170.0 河南鼎仕达机械制造有限公司 1年 矿用PE颚式破碎机大型铁矿石鄂破机大口径复摆式石英石颚式破碎机

【鄂破机】_鄂破机品牌/图片/价格_鄂破机批发_阿里巴巴

赣州市. ¥260.00 成交39笔. PE150*250鄂式石头破碎机 矿山石料破碎机 小型鄂式破碎机. 郑州威锐机械设备有限公司 8年. 郑州市. ¥873.00 成交15笔. 鄂式破碎机 大型矿山岩石可移动碎石机高硬度矿石破碎机源头厂家. 郑州卓辉机械设备有限公司 9年. 郑州市中原区.

鄂破机型号与参数大全(欧版、德版、细鄂版、普通版)

2021年5月25日 鄂破机专业名称鄂式破碎机,无论是破碎生产线、制砂生产线、还是磨粉生产线、选矿生产线,都离不开它。鄂破机出现较早,进料口大,软硬通吃,适用物料广,是矿石开采中比较常见的破碎设备,无论是性能、市场还是价格都很成熟,当然鄂破机从传统型一直不断升级,目分为:普通版鄂式

给矿设备-烟台大成矿山机械有限公司

2022年9月2日 给矿设备 破碎 设备 筛分设备 运输设备 磨矿设备 分级设备 浮选设备 重选设备 浓密设备 地址:烟台市福山区金凤路53号 电话咨询 产品展示 新闻资讯 网站首页

颚式破碎机 Top 1000件颚式破碎机 2023年7月更新 Taobao

颚式破碎机 破碎机 鄂式破碎机100X60 矿石破碎机 实验室破碎机 优惠促销 ¥ 201.96 ¥ 206.08 已售10+件 5.0 8评价 收藏宝贝 找相似 矿山设备鄂式破碎机 鹅卵石鄂破机 移动式花岗岩铁矿石颚式破碎机 7人说“质量很好” ¥ 2000 已售10+件 5.0 10+评价

烟台鄂破机

2014年6月6日 上海矿山设备网提供沙石厂粉碎设备、石料生产线、矿石破碎线、制砂生产线、磨粉生产线、建筑垃圾回收等多项破碎筛分一条龙服务。 山东诚铭建设机械有限公司- 破碎设备- 中国供应商 山东诚铭建设机械有限公司专业从事颚式破碎机、反击式破碎机、圆锥式破碎机、锤式破碎机制砂机等矿山石料

颚式破碎机的优缺点对比介绍 知乎

2022年9月19日 颚式破碎机俗称颚破,又名老虎口。由动颚和静颚两块颚板组成破碎腔,通过模拟动物的两颚运动来完成物料破碎作业。颚式破碎机的优缺点 鄂破机优点 1、生产效率高 该设备破碎腔深,无死区,可提高碎石给料能力和产量,节约能耗,提高生产效率。