移动式破碎站配件

移动式破碎机_百度百科

概览产品理念用途及优点结构应用范围鄂式移动破碎站碎石方法

移动式破碎机是一种新颖的岩石破碎设备,大大拓展了粗碎作业概念领域。

移动式破碎站_百度百科

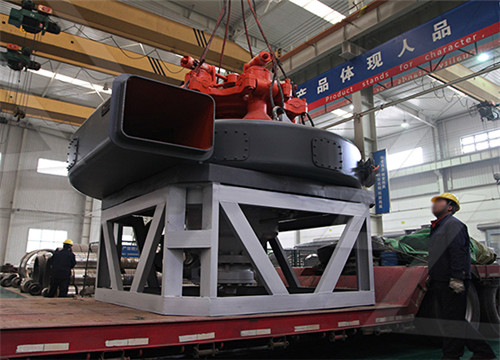

本词条由 “科普中国”科学百科词条编写与应用工作项目 审核 。. 移动式破碎站是指将大块物料进行多级破碎,并按照一定的出料规格进行筛分的机械设备。. 主要用于冶金、化工、建材、水电等经常需要搬迁作业的物料加

轮胎移动式破碎站-轮胎移动式破碎站批发、促销价格、产地

上海市浦东新区 ¥ 652000.00 轮胎移动式破碎线 整条石料线轮胎可移动安装 17.5米车厢移动站 河南泽邦机械设备有限公司 6 年 月均发货速度: 暂无记录 河南 郑州市 ¥ 800000.00

SCIM1213RC6移动反击式破碎站_三一重工移动反击式破碎

产品手册 参数对比 给料系统 最大给料粒度 600mm 最大给料能力 400 预筛筛网层数 2 受料斗公称容积 6m³ 动力系统 品牌 斯堪尼亚/沃尔沃 排放等级 国Ⅲ 额定功率

移动破碎站_百度百科

2023年3月23日 移动式破碎站 主要用于冶金、化工、建材、水电等经常需要搬迁作业的物料加工,特别是用于高速公路、铁路、水电工程等流动性石料的作业,用户可根据加工原料的种类,规模和成品物料要求的不同采

移动式、半移动式、半固定式、固定式4种破碎站详细介绍及优

2020年6月8日 02、半移动式破碎站. 半移动式破碎站又称为模块化机组或雪橇式机组,是将机体安放在露采场内合适的工作水平上,随着作业台阶的推进、延伸用履带式运输车

破碎配件-破碎机配件_恒源破碎机配件

轮式洗砂机 板式给料机 移动破碎站 轮胎移动式破碎站 石头移动破碎站 履带移动式破碎站 YPE-颚式移动破 YPF-反击式移动破 YPY-圆锥式移动破 破碎机配件 圆锥破稀油站 圆锥配

移动破碎机配件|移动破碎站配件|移动式破碎机配件|反击破

反击破移动破碎站 机组配置了——PF系列反击式破碎机,破碎机采用最新制造技术,选用优质高铬板锤、耐磨反击衬板,破碎比大,此外反击破碎机自身成品粒形的优质特点,使

建筑垃圾处理设备,移动破碎站,破碎机,制砂机,破碎机配

2023年4月28日 建筑垃圾处理设备,移动破碎站,破碎机,制砂机,破碎机配件,破碎机厂家_郑州鼎盛工程技术有限公司 专业品质,鼎盛缔造 以提高产品质量和企业市场竞争力为目标,建立良好的企业文化为根本的先进质量管

移动破碎站-专业移动式破碎设备厂家-广西美斯达

2020年8月3日 工程案例. 移动式、履带移动式破碎站、移动筛分系统的倡导和推动者。. 自主开发适合国情的移动破碎筛分系统。. 这一些移动破碎机除了陆续装备国内的大型石场和矿厂外,还通过各种渠道出口到国外。. 更

移动式破碎站-中国移动式破碎站网|新型移动式破碎站|价格表

移动式破碎站介绍. 移动式破碎站是指将大块物料进行多级破碎,并按照一定的出料规格进行筛分的机械设备,主要用于冶金、化工、建材、水电等经常需要搬迁作业的物料加工作业。. 中国路面机械网为您提供移动式破碎站设备资料参考,包括以下设备:南方路

轮胎移动式破碎站-轮胎移动式破碎站批发、促销价格、产地

轮胎移动式破碎线 整条石料线轮胎可移动安装 17.5米车厢移动站. 河南泽邦机械设备有限公司 6 年. 月均发货速度: 暂无记录. 河南 郑州市. ¥ 800000.00.

移动破碎站 郑州一帆机械有限公司

2023年5月25日 郑州一帆机械自主研发生产移动破碎机种类齐全,包括轮胎式移动破碎机和履带式移动破碎剂两大类,其分别包含的移动破碎机有颚式移动破碎机、反击式移动破碎机、圆锥式移动破碎剂、立式冲击破移动式破碎机、移动式筛分站等。欢迎来电咨询:0371

移动破碎站-专业移动式破碎设备厂家-广西美斯达

2018年7月21日 工程案例. 移动式、履带移动式破碎站、移动筛分系统的倡导和推动者。. 自主开发适合国情的移动破碎筛分系统。. 这一些移动破碎机除了陆续装备国内的大型石场和矿厂外,还通过各种渠道出口到国外。. 更多移动破碎站工作视频.

建筑垃圾处理设备,移动破碎站,破碎机,制砂机,破碎机配件,破碎

2023年4月28日 移动式建筑垃圾处置 郑州鼎盛吸收、引进奥地利RCT公司、REV公司先进技术,对建筑垃圾资源化利用的各个环节进行全面系统的研究、开发,推出移动破碎、移动筛分、移动轻物质分离、移动抑尘、多功能保障等五大系列设备,配套齐全,技术先进。

移动式破碎站 粉体网

2022年6月12日 移动破碎站 (移动破碎机)主要用于冶金、化工、建材、水电等经常需要搬迁作业的物料加工,特别是用于高速公路、铁路、水电工程等流动性石料的作业,真正为客户创造出更多新的商业机遇和降低生产成本. 一,一体化整套机组 一体化机组设备安装形式,消除了分

McCloskey履带破碎筛分设备,移动式履带破碎筛分设备,移动

2023年7月13日 I系列反击破履带式移动破碎站 I系列反击破履带式移动破碎站(I44、I44R、I54)是McCloskey International公司标志性产品之一,反击式破碎机、振动筛和返料装置组成的联合设备在保证物料高破碎效率的同时仍保持良好的机动能力;设备运输方便,经过短时间的简单设置,即可快速投入使用,是现场生产

破碎设备,制砂设备,磨粉设备,移动破碎站-黎明重工科技股份

2023年7月21日 30多年来,专注于矿山破碎设备、建筑破碎设备、工业制粉设备和绿色建材设备的研发制造,并提供专业的解决方案和成熟的配套产品,为客户创造价值。. 破碎机. VUS砂石同出系统. 制砂机. 磨粉机. 移动破碎站. 配套设备. 查看详情 我要询价.

美卓配件目录大全_美卓破碎机配件、美卓筛分机配件、美卓

您当的位置: 首页 > 配件目录大全 > 美卓配件 中国路面机械网为您提供美卓配件目录大全,包括美卓破碎机配件、美卓筛分机配件、美卓移动式筛分站配件等工程机械配件目录,较全面的美卓配件目录以供需要徐工配件时查询使用。

移动破碎站的现状及发展 破碎机新闻|矿山机械新闻|械制造

2019年10月17日 三、移动式破碎站具有以下优点:. 1.灵活的机动性:. 它对于普通的移动过渡非常方便,节省了快速进入施工现场的时间。. 更有利于在合理的施工区域进驻,消除了破碎过程中繁琐的钢架结构和基础施工,节省了大量时间。. 2.降低材料成本:. 可以直接选择

移动式破碎机-移动破碎站-移动矿山破碎机-上海山美环保装备

2 之 移动破碎站. 山美移动破碎站可灵活、高效、低成本地转移到石料源场组成复杂的应用。. 这些移动式破碎站包括颚破、反击破、圆锥破、振动筛以及它们的组合式或联合、闭合回路型式的。. 它们能以组装型的方式发运、也可以分装运输。.

破碎机配件_上海恒源冶金设备有限公司

2019年12月26日 破碎机配件. 设备咨询 400-820-2021. 破碎机配件分类大致有:. 圆锥破碎机配件. 圆锥破配件主要有:机架衬套、传动轴衬套、主轴套、主轴衬套、轧臼壁、破碎壁、分料盘、下推力板、碗形瓦、碗形轴

特雷克斯破碎机配件.PDF 原创力文档

2017年8月19日 特雷克斯破碎机配件 特雷克斯特雷克斯公司振动筛品牌企业主要产品:破碎机破碎机圆锥式破碎机颚式送料器垃圾分选设备 筛分机洗矿筒清洗设备特雷克斯提供全系列的移动与固定破碎筛分设备,满足从采石到矿山,从填满到废料处理 的报价获取 特雷克斯破

破碎机都有什么类型? 知乎

2023年5月31日 破碎机的类型很多,按功能性分常见的有以下几种:. 1.粗碎—— 颚式破碎机 。. 颚式破碎机适用于粗碎各种矿石,如需加工小石子、石料,还需配备 细碎机 ,加工出的成品粒度均匀、立体状成品含量高,成品销路高,可满足建筑领域高标准用料需求。. 2.细

SCIM1213RC6移动反击式破碎站_三一重工移动反击式破碎

SCIM1213RC6移动反击式破碎站 三一筑工 5类装备 产品详情 施工案例 性能参数 推荐产品 推荐赚钱 推荐成交赚佣金 产品与解决方案 产品设备 电动化产品 设备配件 解决方案 服务支持 安心服务 服务商 销售商 金融服务 施工案例 投诉与建议

移动破碎站_百度百科

2023年3月23日 移动式破碎站主要用于冶金、化工、建材、水电等经常需要搬迁作业的物料加工,特别是用于高速公路、铁路、水电工程等流动性石料的作业,用户可根据加工原料的种类,规模和成品物料要求的不同采用多种配置形式。我国当的移动破碎站多应用于城市拆迁中建筑垃圾处理工程,将建筑垃圾破碎

高效环保的移动式破碎机,省的多,挣得更多_哔哩哔哩_bilibili

2020年7月24日 云南凯瑞特重工,移动破碎站,移动制砂机、移动筛分站,全国均有合作案例,24小时免费服务热线,移动破碎站全国技术支持,终身售后维护,欢迎到我公司考察!咨询请拨打:, 视频播放量 39、弹幕量 0、点赞数 0、投硬币枚数 0、收藏人数 0、转发人数 0, 视频作者 移动破碎筛分, 作者简介

为什么说移动破碎站是未来破碎设备的主流? 知乎

2019年4月9日 履带式移动破碎机的原理及优势在哪里呢?1. 设备结构紧凑,采用一体化的整套破碎筛分输送机组,无需安装辅助设施,此举大大简化了整个项目的工艺复杂程度,降低物料成本和人力成本,简化设备布局,变相增大了成品料堆的规模,增加了成品转运的空间。