杂木粉碎机

杂木粉碎机 Top 100件杂木粉碎机 2023年7月更新 Taobao

淘宝为你精选了杂木粉碎机相关的热卖商品,海量杂木粉碎机好货任挑任选! 淘宝官方物流可寄送至全球十地、支持外币支付多种付款方式、平台客服24小时在线、由商家提供退

木材粉碎机-木材粉碎机价格、图片、排行 阿里巴巴

1/100 页. 木材粉碎机品牌/图片/价格 木材粉碎机品牌精选大全,品质商家,实力商家,进口商家,微商微店一件代发,阿里巴巴为您找到81,217个有实力的木材粉碎机品牌厂家,

进一步探索

大型木材粉碎机-树根粉碎机-木材破碎机--郑州金鹏还不知道木材粉碎机有什么用途吗?我来给你详细

【杂木粉碎机】杂木粉碎机价格_杂木粉碎机批发_杂木粉碎

2016年4月12日 杂木粉碎机采购批发信息快速查找。 中国制造网为您提供丰富的杂木粉碎机产品信息,方便您快速找到杂木粉碎机的价格,图片,联系方式等,购买杂木粉碎机及

木材粉碎机_百度百科

概览言功能介绍价格适用范围粉碎原理优势技术参数使用说明使用方法

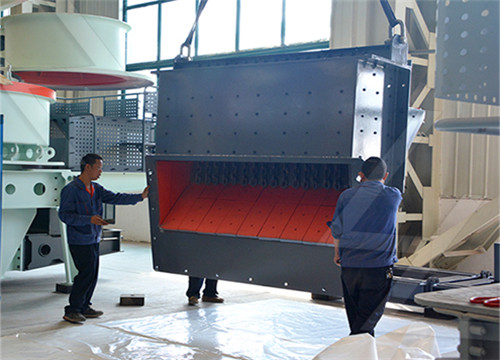

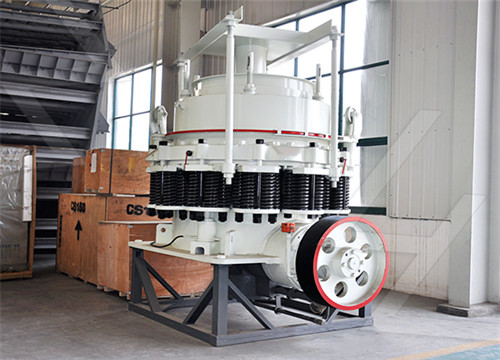

木材粉碎机是由机体、中机体、下机体三部分组成,中机体内装有三重定子大圈、粉碎刀盘和细度分析器。主机采用合金刀头。具有耐磨度高从而也提高了产量。具有粗粉碎、细粉碎、和离心来粉碎,由电机带动粉碎机转子高速运转,使机械产生高速气流对粉碎物料产生高强度的撞击力、压缩力、切割力,并达到独特的粉碎功能。木材粉碎机是一种新型的生产木材系列道生产理想的

树木粉碎机-树木粉碎机价格、图片、排行 阿里巴巴

树木粉碎机品牌/图片/价格 树木粉碎机品牌精选大全,品质商家,实力商家,进口商家,微商微店一件代发,阿里巴巴为您找到36,549个有实力的树木粉碎机品牌厂家,还包括价

杂木粉碎机价格表,杂木粉碎机多少钱/报价走势-中国制造网

杂木粉碎机价格表,杂木粉碎机多少钱,杂木粉碎机报价走势快速查找。 中国制造网为您提供专业的杂木粉碎机产品价格信息和生产厂家信息查询平台,方便您快速找到杂木粉碎

杂木粉碎机 扬木粉碎机 松木粉碎机-农机网 nongjx

2017年12月20日 木屑粉碎机.菇木粉碎机又称之为香菇粉碎机、食用菌粉碎机、食用菌机械、食用菌加工设备,是一种生产优质木粉(锯末)、食用菌原料的木材加工设备。 此系

树木用木材粉碎机打出来的木屑有什么用途? 知乎

2018年10月30日 Y椅之家 用一生做一把好椅子 关注 7 人赞同了该回答 废木材目主要有三个用途: 一是制作生物质颗粒染料,有碳化的(黑的),也有不用碳化的(木头色的)

边角料粉碎做生物质颗粒更安全好用就是你的选择木材粉碎机

2023年6月1日 树枝粉碎机生产现场粉碎15公分以下杂木树枝一次性成木屑方便运输#木材粉碎机#树枝粉碎机#粉碎机#杂木粉碎机#锯末粉碎机#木屑粉碎机. 山峰jixie. 1 0. 力量型的木头破碎机试机效果 输送带自动进料 把废木材粉碎做生物质燃料节能降耗#木材粉碎机#木材破碎

食用菌种植原料菇木粉碎机粉碎杂木树枝出料木屑速度看客户

2023年7月24日 木屑粉碎机粉碎废木材做菌料种植食用菌出料大小可调大口进料方便香菇料粉碎机刀片真给力. 山峰jixie. 22 0. 看视频为您揭晓回收废木材做什么使用吧食用菌粉碎机粉碎成木屑现场实拍#木材粉碎机#木屑粉碎机#食用菌粉碎机#废木材粉碎机#食用菌木材粉碎

树枝粉碎机价格-最新树枝粉碎机价格、批发报价、价格大全

阿里巴巴为您找到38,120个今日最新的树枝粉碎机价格,树枝粉碎机批发价格等行情走势,您还可以找树枝粉碎机鲁宏,树枝树叶粉碎机,园林专用树枝粉碎机,园林绿化树枝粉碎机,园林树枝粉碎机,卧式树枝粉碎机,葡萄树枝粉碎机,果园树枝粉碎机,大型树枝粉碎机,柴油树枝粉碎机市场价格、批发价格等相关

毕业设计(论文)--园艺杂枝粉碎机的设计说明书.doc

2017年1月22日 园艺杂枝粉碎机的设计原理来自于木材粉碎机,其粉碎方式也是相似的。. 以往的方式就是焚烧,这样不但浪费了原材料,而且对于环境的污染也是很严重的。. 但是粉碎机的应用会大大降低原料的浪费和环境污染,杂枝粉碎后的杂枝碎末可以根据现实情况就地

柴油移动式木头粉碎机,大型碎木机,杂木粉碎机 哔哩哔哩

2020年2月22日 65 0. 00:43. 大型1200型木头粉碎机,可移动新型木头粉碎机,柴油移动木头粉碎机. 金诺木材粉碎机. 127 0. 02:04. 1050木屑粉碎机柴油移动杂木粉碎机食用菌干湿木料破碎机木料破碎粉碎机一体机. 金诺木材粉碎机. 84 0.

柴油机木屑粉碎机移动粉碎杂木树枝出料直接做食用菌原料好

2023年7月3日 柴油机木屑粉碎机移动粉碎杂木树枝出料直接做食用菌原料好用就是你的需求#木材粉碎机#树枝粉碎机#粉碎机#杂木粉碎机#木屑粉碎机#移动粉碎机#食用菌粉碎机, 视频播放量 0、弹幕量 0、点赞数 0、投硬币枚数 0、收藏人数 0、转发人数 0, 视频作者 山峰jixie, 作者简介 ,相关视频:出料速度快大口

小型移动式树枝粉碎机省时省力效率高移动户外处理杂木做

2023年3月27日 树枝粉碎机生产现场粉碎15公分以下杂木树枝一次性成木屑方便运输#木材粉碎机#树枝粉碎机#粉碎机#杂木粉碎机#锯末粉碎机#木屑粉碎机. 山峰jixie. 1 0. 边角料粉碎做生物质颗粒更安全好用就是你的选择木材粉碎机#木材粉碎机#边角料粉碎机#生物质颗粒粉

多功能木材加工粉碎机刀片真给力粉碎树皮杂木做有机肥发酵

2022年3月11日 多功能木材加工粉碎机刀片真给力粉碎树皮杂木做有机肥发酵菌种变废为财富利润空间更大. 椰蓉用木材粉碎机粉碎的出料有什么用呢?. 海南客户带料来厂试机考察#木材粉碎机#粉碎机#碎木机#多功能粉碎机#木材粉碎机厂家#锯末粉碎机#杂木粉碎机. 木材粉碎

杂木树枝粉碎机 Top 400件杂木树枝粉碎机 2023年3月更新

去哪儿购买杂木树枝粉碎机?当然来淘宝海外,淘宝当有406件杂木树枝粉碎机 相关的商品在售。 全球 搜索 全部分类 服饰 家具家居 3C数码 母婴 美妆洗护 食品 大小家电 汽车 医药健康 虚拟 行业其他 针织衫男 秋装 男款秋装外套

打木屑机器,木屑粉碎设备,锯末木屑粉碎机_哔哩哔哩_bilibili

2020年3月14日 -, 视频播放量 164、弹幕量 0、点赞数 0、投硬币枚数 0、收藏人数 0、转发人数 2, 视频作者 金诺木材粉碎机, 作者简介 让废旧木材变废为宝,相关视频:多功能木头木材粉碎机废旧木材木料粉碎机木材锯末粉碎机,大型树枝木材粉碎机木头一次性锯末粉碎机杂木粉碎机青杠木粉碎机杉木粉碎机木料

菇木粉碎机好进料快出料高效率客户使用粉碎杂木圆木快回报

2023年6月18日 大口直接进料25公分原木省时省力的1500型菇木木屑粉碎机出料大小可调做食用菌原料. 山峰jixie. 47 0. 木材破碎机试机效果不错 每台设备出厂调试好 保证客户放心使用 #木材破碎机 #碎木机 #实体生产厂家 #木材粉碎机#综合破碎机#树枝粉碎机#杂木破碎

边角料杂木破碎机 综合木材树干破碎机 作用力度大 效率高_哔

2020年3月24日 人活着是为了什么就是为了钱钱钱搞一台综合木材破碎机粉碎废旧木头边角料让你大赚起来#木材破碎机#综合破碎机#废旧木材破碎机#木头破碎机#边角料粉碎机#木材粉碎机. 山峰jixie. 60 0. 00:17. 遍地都是成本低的树根杂木粉碎生物质电厂燃料 价值一下翻了

木材综合破碎机是户外移动处理杂木的好帮手配柴油机动力强

2022年7月12日 户外移动处理杂木好用的木材综合破碎机做电厂燃料节能降耗价值翻倍可配柴油机动力. 山峰jixie. 12 0. 00:48. 杂木树枝用木材综合破碎机破碎处理后做燃料让你省心省力省人工赚的多#木材破碎机#综合破碎机#杂木破碎机#树枝破碎机#燃料木材破碎机@A000粉碎机破碎

直播树根破碎机下料生产实力出料哗哗的圆盘式树墩撕碎机

2022年3月10日 移动式圆盘树根破碎机一小时粉碎杂木树枝10-15吨送发电厂生物质颗粒厂欢迎考察试机#树枝粉碎机#树根破碎机#圆盘树根破碎机 #移动式圆盘树根破碎机#电厂燃料破碎机 山峰jixie 108 0 大口破碎木头实力开挂模式的圆盘树根破碎机粉碎树墩杂木直接

杂木粉碎机_杂木粉碎机价格_优质杂木粉碎机批发/采购商机

搜好货网(912688)您提供各种杂木粉碎机的供求信息价格,杂木粉碎机资讯,杂木粉碎机 图片,杂木粉碎机厂家等,查找更多的杂木粉碎机产品信息和供应商请上搜好货网。 手机网站 老板,欢迎来到搜好货![请登录] [免费注册

粉碎机毕业设计说明书(61页)-原创力文档

2020年8月22日 1.5 本课题设计的创新点 本毕业设计题改变了传统单一的粉碎方式, 将锤片式和盘片式粉碎原理进行集成, 使粉碎机粉碎范围得到很大程度的拓宽,降低了成本,该机设计对促进饲料工业的发 展具有一定现实意义。. 2 湖南工业大学本科毕业设计(论文) 第

年关加班除尘全套木材粉碎机可配置电机柴油机动力可移动可

2023年1月11日 木材粉碎机 木材破碎机 沙克龙木材粉碎机 移动木材粉碎机 柴油机木材粉碎机 除尘木材粉碎机 粉碎机, 视频播放量 0、弹幕量 0、点赞数 0、投硬币枚数 0、收藏人数 0、转发人数 0, 视频作者 山峰jixie, 作者简介 ,相关视频:移动式固定式木材粉碎机按需配柴油机电机动力 上面大进料口方便可配输送

杂木木屑粉碎机 Top 50件杂木木屑粉碎机 2023年7月更新

淘宝为你精选了杂木木屑粉碎机相关的热卖商品,海量杂木木屑粉碎机好货任挑任选!淘宝官方物流可寄送至全球十地、支持外币支付多种付款方式、平台客服24小时在线、由商家提供退换货承诺,让你简单淘到宝

【杂木粉碎机】杂木粉碎机价格_杂木粉碎机批发_杂木粉碎

2016年4月12日 杂木粉碎机采购批发信息快速查找。中国制造网为您提供丰富的杂木粉碎机产品信息,方便您快速找到杂木粉碎机的价格,图片,联系方式等,购买杂木粉碎机及其相关产品就上中国制造网。