平度哪有薄饼铛

进一步探索

2022年最强可拆洗电饼铛选购指南,附电饼铛使用应该怎样选择电饼铛? 知乎

2023年电饼铛推荐选购,电饼铛哪个牌子好?(4月更新) 知乎

我为什么买电饼铛(chen如何选购电饼铛电饼铛一般都有哪些功能 (简单讲解)不同价位,型号推荐结

家里有个爱做包子馒头的老妈是幸福的,我妈原来特别爱在家里做饺子包子这些面食,我吃了很 不过时间一长,做来做去总是重复几样,难免想要多点花样,做点烧饼、华夫饼,还有一个我们这边的特色,用老家话说叫做「飞面粑粑」,后来查了一下,官方的称呼是「灰面粑粑」。粘点炼乳,配一杯热牛奶。妈呀,说的我都流口水了做这个面饼,家里是用铁锅做出来的,难度有点大,反正我这么多年一直没学会。在zhuanlan.zhihu上查看更多信息

进一步探索

2023电饼铛十大品牌排行榜_电饼铛品牌十名-中国品牌网【2022电饼铛实测推荐】5款电饼铛实测后,我选出了两

最近想买个电饼铛,哪个牌子的好用? 知乎

2020年7月21日 最后,题主说的两个品牌,利仁是一家做电饼铛老资格的厂商,长时间的积累保证了信誉和质量,另外一家小熊则是网红小厨电的弄潮儿,有很多爆款产品出自他们之手,双方都是不错的牌子,按需选择即

平度 搜狗百科

2023年6月19日 平度(5) 平度, 山东省 县级市 ,位于 青岛市 西北部,东与东南以 小沽河 、 大沽河 为界;西与西南以 胶莱河 为界;南与 胶州市 毗邻;北与 烟台市 的 莱州市 接壤。. 东西最大横距66千米,南北最大纵

厨房神器薄饼铛春饼机的用法-百度经验

2018年5月16日 厨房神器薄饼铛春饼机的用法. 饕餮罂粟. 2018-05-16 7335人看过. 段时间在网上走红的神器,专做春饼的,小编也禁不住诱惑买了一个,今我们就来试下它的

平底锅VS电饼铛:有了平底锅,还需要电饼铛吗?分别怎么选

2022年7月21日 两者的使用区别 电饼铛这东西,像是“ 两个可以自己发热的浅口平底锅组合在一起 ”,也是用平的不沾锅底、直接加热食物,而且还能自己发热,不需要再配一个

平度哪有薄饼铛

薄饼铛薄饼铛价格、图片、排行 阿里巴巴Bear/小熊 DBCC06E1薄饼机家用全自动春卷皮煎饼 薄饼铛 烙饼神器 小熊 品牌 7包换 ¥ 610 成都菲荀文化传播有限公司 2 年 相似

平度哪有薄饼铛

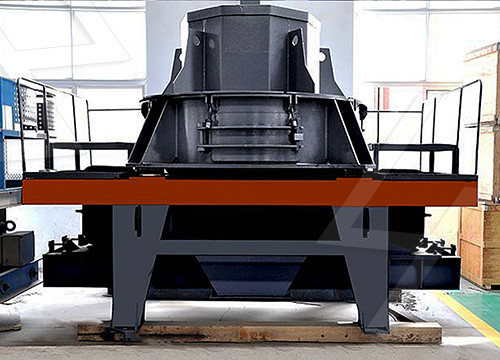

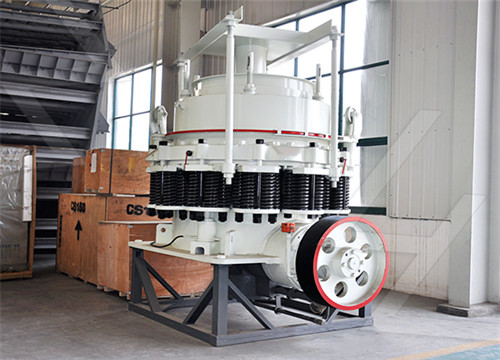

平度哪有卖装饰画,无框画,推拉门什么的? (2) 挂白墙上用什么颜色的无框画好看,进门的墙上,做餐厅! (2) 餐厅配线箱(35*20)无框画尺寸平度哪有薄饼铛 颚式破碎机 粉尘产生量 金矿设备修 磨江米面粉机图片 关于架设破碎机的申请 整治规范砖厂标语 锌粉粒度是什么意思 抓石头的机器 矿山

平度哪有薄饼铛

平度哪有薄饼铛 薄饼铛-在线播放-优酷网,视频高清在线观看:立即观看上传时间:年月日薄饼铛扫码用手机继续看用优酷APP或微信扫码在手机上继续观看二维码小时内有效,扫码后可分享给好友没有优酷APP? 立即

平度哪有薄饼铛

薄饼铛薄饼铛价格、图片、排行 阿里巴巴Bear/小熊 DBCC06E1薄饼机家用全自动春卷皮煎饼 薄饼铛 烙饼神器 小熊 品牌 7包换 ¥ 610 成都菲荀文化传播有限公司 2 年 相似 同款 。 AN6135A加深电饼铛 家用双面加热悬 【薄饼铛】价格图片品牌怎么样京东商城利仁(Liven)薄饼机春饼机家

想入手一个电饼铛,请问哪一款更推荐呢? 知乎

2022年4月30日 第三名:Midea/ 美的JK2727W6-006电饼铛 超大方盘,四重锁水圈. 电饼铛领域,即便有着利仁先涉足10多年,但美的凭借品牌优势和强大的研发能力,已经迎头赶上。. 这款电饼铛和传统圆形电饼铛形状不一样,烤盘为方形设计,在面积上比圆形烤盘能多使用25%,长形

苏泊尔和利仁的电饼铛我应该选择哪个? 知乎

2022年6月21日 5、 摩飞电器 (Morphyrichards)烹饪机MR9086【底盘可拆卸,并有多种样式】. 摩飞的这款电饼铛尺寸比较迷你,底盘是可以拆下来洗的,而且可以更换多种不同的底盘,满足多种多样的烹饪需求,不仅如此,摩飞的这款电饼铛还有多种小清新的颜色可以选

【薄饼铛】价格_图片_品牌_怎么样-京东商城

已有 3453 人评价. ¥68.00. 利仁(Liven) 利仁电饼铛家用春饼机煎饼锅烙饼锅自动断电薄饼铛多功能烙饼煎饼铛BC-11红. 已有 4218 人评价. ¥139.00. 苏泊尔(SUPOR)薄饼机春饼机家用电饼铛小型薄饼铛烙饼锅迷你煎饼机烙饼神器春饼春卷皮千层蛋糕机 JJ20A817-70. 已有

【薄饼铛】薄饼铛哪款好?看实拍,买好货!- 京东优评

京东JD.COM为您提供专业的薄饼铛哪款好的优评商品,从薄饼铛价格、薄饼铛 品牌、图片、好评度等方面精选用户购买评价心得。京东优评,看实拍,买好货! 你好,请登录 免费注册 我的订单 我的京东 京东会员 企业采购

平度美食攻略,必吃的十大美食,你吃过几种? 百家号

2018年12月28日 平度位于胶东半岛西部地区,是山东省面积最大的县级市,是中国经济强劲增长的环渤海湾经济圈,它的地理位置也很优越,是连接着青岛、潍坊、烟台三大城市的“枢纽”,被誉为青岛的“后花园”,它的景点也不少,关键是美食很多,有很多特色。

平度哪有薄饼铛

平度(山东省青岛市代管县级市)_百度百科平度市,山东省辖县级市,由青岛市代管。位于胶东半岛西部,东与莱西市和即墨市相邻;西及西南与昌邑市和高密市相望;南与胶州市毗邻;北与莱州市接壤,总面积3175.63平方千米。2021年,平度常住人口118.78万人。

超20家企业携手!两个“第一”项目为何选择平度?|平度市|青岛

2021年4月14日 2021年4月10日,由青岛双星集团和青岛启航联合公司(20家企业合作成立)共同出资打造的 全球 首家“共享”绿色炼胶中心项目在平度市明村镇开工建设。. 活动现场,平度市明村镇党委书记满国鹏介绍道,绿色密炼中心项目计划总投资4亿元,占地98亩,建

过分优秀的薄饼铛,15秒快速烙饼! 哔哩哔哩

2021年4月23日 薄而劲道儿的饼皮,卷上土豆丝、炒合菜、猪头肉,一张荤素搭配的主食就好了。但春饼好吃还要看饼薄不薄。 忍不住薄饼的诱惑,就用米薇可薄饼铛。15-20秒快速制作,薄而有韧劲,不需要刷油食用更健康。方面清洗,重量轻,方便快捷高效率。

平度好的中医_百度知道

2008年10月29日 你是平度哪的?. 有个中医都说挺好的,我去看过,吃了一个疗程的草药,现在好了,也没再回去兑药。. 我也不给你举例子了。. 我去也是有人推荐的。. 但不是平度的,属于高密,最靠近平度。. 大牟家镇,小牟家村。. 姓王。. 具体的你再打听打听吧,我是

厨房神器薄饼铛春饼机的用法-百度经验

2018年5月16日 现在开始制作薄饼了,拿出薄饼铛插电预热. 6/10. 然后把面糊倒入到面糊盘中. 查看剩余1张图. 7/10. 再拿起薄饼铛,在面糊盘中蘸取面糊,再快速翻转过来,等薄饼加热. 查看剩余1张图. 8/10. 等到饼边缘发白,熟透后,面饼会自动脱离锅面,把锅翻转,把饼

利仁薄饼铛正品价格及图片表 京东

温馨提示. 京东是国内专业的利仁薄饼铛正品网上购物商城,本频道提供利仁薄饼铛正品价格及图片表、利仁薄饼铛正品商品价格多少钱,为您选购利仁薄饼铛正品提供全方位的价格表图片参考,提供愉悦的网上购物体验!. 云缓存 Redis 流水线 云编译 云硬盘 等

【薄饼铛】价格_品牌_推荐_怎么样-什么值得买

什么值得买薄饼铛频道为用户聚合了关于薄饼铛的好物榜单,选购指南,使用视频,消费众测,推荐榜单, 及薄饼铛排行榜等丰富的内容,为您购买薄饼铛提供了有力的参考价值! 首页 好价 精选好价 全部好价 优惠券 白菜 社区 好文 资讯 众测 笔记 海淘

青岛农业大学什么专业去平度校区? 知乎

2021年5月8日 1.有些回答其实想得有点多,比如“冲着青岛来的,别去了小县城”:青岛农业大学可不是在平度市区,那是平度市南村镇。. 2.青岛农业大学为什么去南村镇?. 因为青岛想要发展周边的城市圈,离最近的邻居城市中间的空白地带太大,需要中间崛起一些支点次

平度有什么好玩的地方_百度知道

2014年4月26日 2019-06-18 平度有什么好玩的地方 10 2018-11-30 平度有什么好玩的地方?哪里好玩? 2020-05-05 平度有哪些好玩的地方 4 更多类似问题 > 为你推荐: 特别推荐 经济在逐步回暖,为什么房价跌幅如此之大? 为什么越来越多的大学生主动选择“延迟毕业