石灰石矿变黄金矿

答复数: 6

干货 石灰石矿山无废料整体开采(骨料、制砂、制粉)工艺

一、石灰石矿开采利用现状二、石灰石矿山综合利用解决方案优点:缺点:三、石灰石用途表

石灰石是常见的一种非金属矿产,是用途极广的宝贵资源。石灰岩在人类文明史上,以其在自然 1、资源利用率低目正规开采的石灰石矿山资源利用率均达到90%以上,而民采矿山资源利用率只有40%,由于 2、矿山规模小,开采技术落后在zhuanlan.zhihu上查看更多信息

进一步探索

石灰石矿露开采工艺流程.ppt-文档在线预览石灰石矿露开采工艺流程培训2.ppt 29页 原创力文档

石灰石矿山开采投资,这些知识你了解吗? 知乎

2019年8月5日 拿下石灰石矿山靠项目取胜 过去拿矿,一般是先发现矿产,再按照程序办证,只要有的资金和“关系”便可以搞定,方法较简单。 未来政府部门对矿产资源严格管

精华 || 史上最全矿石品位汇总——建议收藏,慢慢细品

2017年9月12日 是圈定矿体、计算储量的一项主要指标或依据是用以圈定矿体的单个样品中,有用组分含量的最低标准,作为划分矿与非矿(围岩或夹石)界限的最低品位。边界品位应高于选矿后尾矿中的含量。2、工业品

石灰石是什么?石灰石的用途及发展景 知乎

2022年5月17日 石灰石主要分为五大类,不同性质的石灰石用途也不一样,是生活中必不可少的原料。 一、石灰石是什么: 石灰石主要成分碳酸钙(CaCO3),石灰和石灰石大量用做建筑材料,也是许多工业的重要原

自备黄山石灰石矿山800万吨/年技改工程可行性研究报告_项目

2021年4月26日 自备黄山石灰石矿山800万吨/年技改工程 1、基本情况 (1)项目概述 本项目拟通过对原有矿山生产线进行技术改造、设备更新,形成 2x1200t/h石灰石生产线,将

石灰石行业市场机遇及发展景分析 知乎

2019年9月10日 石灰石是常见的一种非金属矿产,是用途极广的宝贵资源。石灰石是以石灰岩作为矿物原料的商品名称。石灰岩在人类文明史上,以其在自然界中分布广、易于获取的特点而被广泛应用。作为重要的建筑材料有着悠久的开采历

生石灰、熟石灰、石灰石,傻傻分不清楚 知乎

2020年1月14日 石灰石 石灰石主要成分碳酸钙(CaCO3)。石灰和石灰石是大量用于建筑材料、工业的原料。石灰石可以直接加工成石料和烧制成生石灰。生石灰CaO吸潮或加水就成为熟石灰,熟石灰主要成分

石灰石矿石价格-最新石灰石矿石价格、批发报价、价格大全

阿里巴巴为您找到11,772个今日最新的石灰石矿石价格,石灰石矿石批发价格等行情走势,您还可以找市场价格、批发价格等相关产品的价格信息。阿里巴巴也提供相关石灰石矿石供应商的简介,主营产品,图片,销量等全方位信息,为您订购产品提供全方位的价格参考。

你就知道尤溪有铅锌矿?那可能要看看这篇文章了

2017年4月20日 你就知道尤溪有铅锌矿?. 那可能要看看这篇文章了. 尤溪县地质结构多样,矿藏资源丰富。. 发现境内有金属矿藏:铁、锰、钨、锡、银、铅锌矿、多金属矿(铜、铅、锌)、黄金矿、稀土矿、辉相矿及放射性铀、钍等。. 非金属矿有:石灰石、大理岩、白云

石灰岩_百度百科

石灰岩主要是在 浅海 的环境下形成的。 石灰岩按成因可划分为粒屑石灰岩(流水搬运、沉积形成)、生物骨架 石灰岩和化学、生物 化学石灰岩。按结构构造可细分为 竹叶状灰岩、鲕粒状灰岩、豹皮灰岩、团块状灰岩等。石灰岩的主要化学成分是CaCO 3 易 溶蚀,故在石灰岩地区多形成石林和溶洞

石灰石_百度文库

石灰石矿与水泥灰岩矿什么区别? 是一种矿么? 石灰石矿的主要成分是碳酸钙CaCO3,石灰石是一种含有单个方解石矿物成分的岩石,方解石成分占95%,其含有的另外少量矿物质有白云石、菱铁矿、石英、长石、云母以及能够体现石材颜色的粘土矿物质。

我国石灰石行业消费现状、发展景及市场风险分析_产品

2020年12月18日 1、石灰石行业消费现状. 从当国内外石灰石需求情况看,全世界每年需求量约为3.6亿吨左右,但80%为普通用途。. 优质石灰因资源少,产量低,市场缺口较大。. 近几年,亚太地区各国因本国内石灰石资源不足,每年要从中国进口石灰石超过百万吨。. 从

衡阳市人民政府门户网站-矿产资源

2020年1月11日 全市已发现的矿产69种,已探明资源储量的矿种有57种,其中能源矿产6种,金属矿产29种,非金属矿产33种,水气矿产1种。. 实施地质勘查项目(含续作项目)22个,新发现大中型矿产地1处。. 衡阳市是湖南省著名的有色金属之乡,也是省内重要的非金属矿

湖南发布绿色矿山名录(第一批),67家矿山企业上榜!_水泥

2020年1月29日 日,湖南省自然资源厅公布 《湖南省绿色矿山名录(第一批)》 ,67家矿山企业上榜,分别为:. 长沙湘宁水泥有限公司石灰石矿. 中材株洲水泥有限责任公司马家桥水泥用石灰岩矿. 株洲市龙洲矿泉水有限公司宝矿泉水厂. 华新水泥(株洲)有限公司谭家冲

石灰石价格走势_今日最新石灰石价格行情_石灰石矿石多少钱

2023年3月14日 石灰石介绍和报价 矿道网点评:石灰石主要成分碳酸钙(CaCO3)。石灰和石灰石是大量用于建筑材料、工业的原料。石灰石可以直接加工成石料和烧制成生石灰。生石灰CaO吸潮或加水就成为熟石灰,熟石灰主要成分是Ca(OH)2,可以称之为氢氧化

石灰石矿全面退出攀枝花苏铁保护区,攀钢40年矿权落下帷幕!

2020年4月17日 石灰石矿矿长许华奎介绍,石灰石矿生产的熔剂石灰岩,是攀钢高炉冶金生产必不可少的辅助原料,每年一半以上用料都由石灰石矿供给。 停产后,距离攀钢100公里采购半径内的熔剂用石灰石生产能力,暂不能满足攀钢需求,而替代矿山需要6年建设周期,短时间内无法满足原料供应。

露石灰石矿山开采的规划技术要点及安全措施,矿山开采

2020年3月12日 1、露石灰石矿山开采规划中首先要对生产能力进行确定. 由于矿山开采规划是对整个生产过程进行全面详细的规划,其中就包括生产能力的确定,只有确定了整个矿山的生产能力,才能对运输系统、采掘方法进行规划和确定。. 因此在露石灰石矿山开采规划

真正的矿山生活是什么样子?-某石灰石露矿山实习

2020年9月9日 在2019年的夏,作为一个大三的学生,亲身参与了某露石灰石矿山工地的实习。对于我,这是人生第一次下矿山。看下图,可能这是很多人的看法、其实不然,这只是地下矿山的样子,而我去的是露

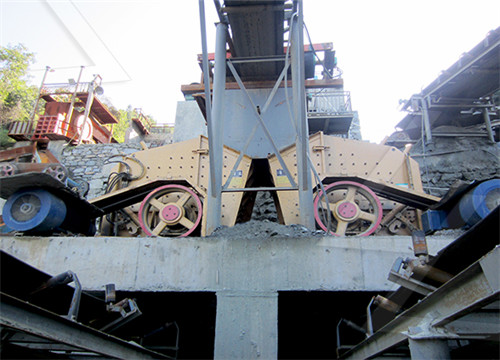

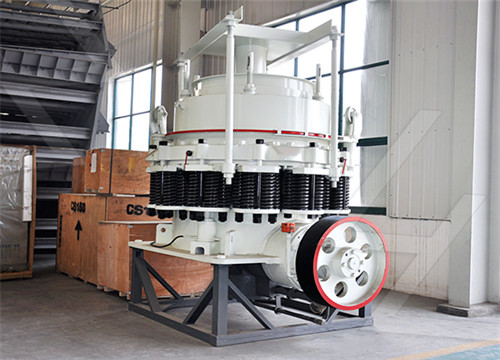

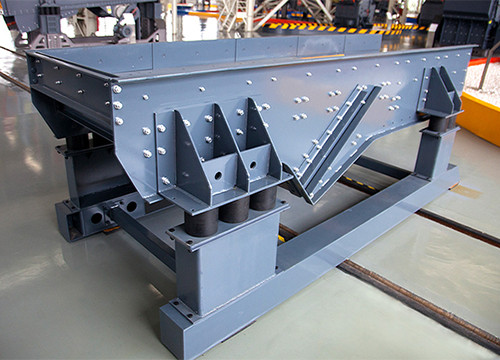

石灰石矿山无废料整体开采(骨料、制砂、制粉)工艺介绍!

2020年11月30日 石灰石矿 综合利用(骨料、制砂、制粉)流程图如下图所示。石灰石矿山综合利用解决方案 优点: 1、矿石得到最大化利用:产品有骨料、机制砂、石粉、精品石粉。如果有制粉设备建议先开采表层岩石,将其粉尘用于抹墙粉,然后在正常生产

石灰石矿山开发利用方案(--公司--矿山).doc 原创力文档

2017年1月6日 石灰石矿开采加工建设项目可行性研究报告.doc 提高患者责护知晓率.课件.ppt 2023年氟化物行业市场突围建议及需求分析报告.docx 太平洋保险风险与风险管理课件.ppt 2023年间二甲苯行业市场需求分析报告及未来五至十年行业预测报告.docx 头脑风暴训练

一文了解 灰岩砂石矿山尾矿综合利用途径_石灰石

2020年11月3日 2、石粉综合利用. 石粉是指建砂石骨料加工过程中产生的粒径小于0.075mm(水工混凝土中定义粒径小于0.16mm)的粉状颗粒物。. 综合利用石粉因其母岩的岩性及性能不同而不同。. 石灰石粉在混凝土行业的应用研究已有较长时间,作为尾矿的主要成分,如何利用

梭鱼湾商务区、泉水石灰石矿,大连未来的“黄金地” 腾讯网

2021年3月18日 梭鱼湾商务区、泉水石灰石矿,大连未来的“黄金地”,有土地,就有机会。土地推介会历来被称为楼市风向标,今年,大连有哪些重点板块值得关注?昨日,2021大连市内四区经营性建设用地第一次土地招商推介会隆重举办,重点推介了梭鱼湾和泉水两大板块的

泉水东这碟开胃小菜能否引出石灰石矿的期待? 知乎

2021年6月22日 石灰石矿其实曾经对周边生活、工作的人来说是一种煎熬的存在。想象一下,每在pm10 爆表的环境下,还要忍受巨大的噪声污染,除此之外没日没夜的载重车也让周边的道路满目疮痍,出行的安全隐患也让人提心吊胆。这就是曾经周边居民的

为什么石英矿常伴生金矿? 知乎

2015年7月22日 为什么石英与金矿经常伴生,原因其他答案说得很清楚了:中低温热液成因的石英常常与含金银等 硫化物 的 成矿流体 是一起的,因此,寻找石英脉型金矿的最明显的 找矿标志 就是石英脉,还有其他的 黄铁矿 化等等,这里面常产出明金,大的就是 狗头金