羊毛破碎机

羊毛切断粉碎机 纤维切断机 尿不湿卫生棉破碎机 废旧衣服碎

羊毛切断粉碎机 本机应用旋扭动刀与定刀切合点移动剪切设计,采用多种优质特殊材料,经过几百道工序精密加工而成.可快速切碎各种废布头,棉纺废纱,废旧服装,棉絮,化纤,亚麻,皮革,

羊毛粉碎切碎机 小型羊毛破碎机厂家 出口棉纤维切碎机广东

阿里巴巴羊毛粉碎切碎机 小型羊毛破碎机厂家 出口棉纤维切碎机广东,化纤机械,这里云集了众多的供应商,采购商,制造商。这是羊毛粉碎切碎机 小型羊毛破碎机厂家 出口棉纤

纤维原料开松机 羊毛化纤破碎机 涤纶碎布开松机 1688

这是纤维原料开松机 羊毛化纤破碎机 涤纶碎布开松机的详细页面。. 订货号:,加工定制:是,货号:WL013,品牌:沃历德,种类:非织造布单机设备,型

羊毛破碎机 碎布机 棉布切碎切断碎片机 无纺布口罩海绵粉碎

这是羊毛破碎机 碎布机 棉布切碎切断碎片机 无纺布口罩海绵粉碎机的详细页面。 订货号:,品牌:金石宏盛,货号:,型号:HSC-100,产品别名:切碎

新型羽毛粉碎机 头发切碎机 羊毛打散机 耕晖-阿里巴巴

阿里巴巴新型羽毛粉碎机 头发切碎机 羊毛打散机 耕晖,粉碎机,这里云集了众多的供应商,采购商,制造商。 这是新型羽毛粉碎机 头发切碎机 羊毛打散机 耕晖的详细页面。

羊毛粉碎破碎机-新航纤维切断机械研究所-全球机械网移动站

2019年8月22日 羊毛粉碎破碎机-新航纤维切断机械研究所信息由青州市新航纤维切断机械研究所提供,粉碎破碎机机器特点:1、厚重动刀,破碎效率高2、动力及定力均用合金钢

破碎机都有什么类型? 知乎

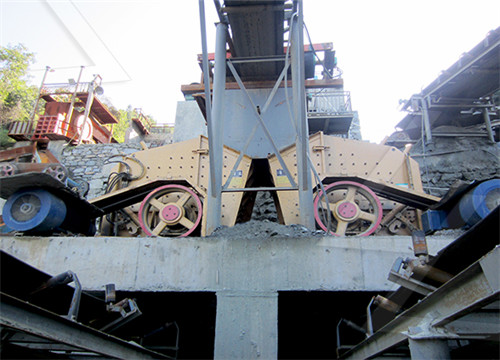

2023年5月31日 1、一级破碎机——颚式破碎机(粗碎) 颚式破碎机简称为颚破,用于物料的粗破。它的主要优点是:适用于硬度中硬及以上的物料破碎,相比于其他破碎机,颚式破碎机的结构简单、维修方便、价格便宜。

切羊毛机器 羊毛破碎机 保温颗粒羊毛切块机 羊毛动物毛粉碎

2022年12月2日 切羊毛机器 羊毛破碎机 保温颗粒羊毛切块机 羊毛动物毛粉碎机 羊毛饲料添加打碎机, 视频播放量 3、弹幕量 0、点赞数 0、投硬币枚数 0、收藏人数 0、转发人数

破碎机_百度百科

常用的破碎机械有颚式破碎机、旋回破碎机、圆锥式破碎机、辊式破碎机、锤式破碎机和反击式破碎机等几种。 破碎机 颚式破碎机 介绍: 颚式破碎机 是利用两 颚板 对物料的挤压和弯曲作用 ,粗碎或中碎各种硬度物料的

食品工厂机械与设备习题及答案(精品多篇) 豆丁网

2021年1月3日 食品工厂机械与设备习题及答案(精品多篇)第一章判断题1.我国尚未颁布食品机械设备分类标准。()2.食品加工机械设备多为成套设备。()3.食品加工机械设备应当全由不锈钢制造。(4.所有不锈钢材料在任何场合均不生锈。5.各种不锈钢的基本成分是铁和

破碎机_百度百科

介绍:颚式破碎机是利用两颚板对物料的挤压和弯曲作用 ,粗碎或中碎各种硬度物料的破碎机械。 其破碎机构由固定颚板和可动颚板组成,当两颚板靠近时物料即被破碎,当两颚板离开时小于排料口的料块由底部排出。 它

浙江丰利粉碎设备有限公司,超微粉碎机,环保粉碎机,食品粉碎

2019年8月24日 公司简介. 浙江丰利粉碎设备有限公司(身为嵊州市机械厂)专注超微粉碎设备制造38年,集粉体(粉碎)工程研发、方案设计、技术服务、技术咨询、生产制造、销售应用为一体的科技型企业,公司拥有一支专注于粉体公司技术研发的创新团队,为客户提供

不同破碎方式的破碎机有何优缺点? 知乎

2021年8月16日 一、先说挤压式粉碎的代表颚式破碎机: 鄂破的优点有:v型破碎腔加上挤压工作原理使得鄂破具有高破碎力和大破碎比的特点。 而且鄂破的整个构造简单紧凑,便于安装维修,衬板等易损件也耐磨耐用。鄂破的缺点有:鄂破的破碎方式其实较为粗犷,不适宜破碎软物料及含水量大于10%的物料,否则

破碎机的类型有哪些? 知乎

2019年7月18日 而目破碎机的类型有很多:颚式破碎机、锤式破碎机、反击式破碎机、圆锥破碎机、辊式破碎机、制砂机等等。. 各类破碎机的结构、规格不同,所适应的物料也是不同的。. 因此,一定要根据物料的特性选择破碎设备。. 虽然不同类型的破碎设备都是对物料

羊毛粉碎破碎机-新航纤维切断机械研究所-全球机械网移动站

2019年8月22日 羊毛粉碎破碎机-新航纤维切断机械研究所信息由青州市新航纤维切断机械研究所提供,粉碎破碎机机器特点:1、厚重动刀,破碎效率高2、动力及定力均用合金钢铸造,坚固,使用寿命长3、铁框架板材厚,可抗高扭矩,非

混凝土块破碎用哪种破碎机效果好多少钱一台? 知乎

2021年12月22日 1、固定式混凝土块破碎机. 种类:颚式破碎机、反击式破碎机、圆锥式破碎机、旋回破碎机. 产量:1-3200t/h. 价格:根据不同种类、不同产量,单台设备价格在2-200多万. 特点:适合固定作业场地,在生产线中表现突出,产量大,投资低,回本快. 2、移

切割式研磨机对羊毛的处理以探究蛋白分解酶的作用效果

2017年2月20日 破碎机 颗粒图像测试仪 纳米粒度仪 公司品牌 品牌传达企业理念 德国飞驰 友情链接 废弃羊毛 破碎的建模条件 此项研究涉及羊毛水解加工到角蛋白水解物的两个阶段(碱性预处理和酶水解)。使用的蛋白水解酶是

撕碎机的设计原理是什么,撕碎机和破碎有什么区别? 知乎

2019年3月27日 撕碎机属于低速剪切式破碎机。其结构是由两个刀轴和特殊设计刀型,是通过剪切、撕裂和挤压使物料达到减小物料尺寸。 另一种破碎机就是除了固废破碎机之外的矿石破碎机,锤片式破碎机、颚式破碎机、对辊式破碎机,以及圆锥型破碎机 这类破碎机适用于矿山,石头,建筑垃圾的破碎。

羊毛切断粉碎机 纤维切断机 尿不湿卫生棉破碎机 废旧衣服碎

阿里巴巴羊毛切断粉碎机 纤维切断机 尿不湿卫生棉破碎机 废旧衣服碎布机,其他粉碎设备,这里云集了众多的供应商,采购商,制造商。这是羊毛切断粉碎机 纤维切断机 尿不湿卫生棉破碎机 废旧衣服碎布机的详细页面。订货号:,品牌:晨兴,型号:CX-046,货号:,适用物料:多种

请问煤矿用破碎机,煤炭粉碎用什么破碎机好? 知乎

2019年11月4日 1.重锤式破碎机. 煤炭原料大小不等,选择重锤式破碎机可将大小1700mm的煤炭原料进行破碎作业,不仅仅如此,还能将煤炭直接进行粗、中、细碎作业,省去了一台粗碎颚式破碎机,破碎之后的煤炭粒度在5-10mm、10-20mm之间,同时还将破碎作业中的针片

机械原理课程设计--洗瓶机 豆丁网

2012年4月13日 机械原理课程设计说明书机械原理课程设计--洗瓶机工学院机械系2011年10机械原理课程设计是使学生全面、系统掌握和深化机械原理课程的基本原理和方法的重要环节,是培养学生机械运动方案设计、创新设计以及应用计算机对工程实际各种机构进行分析和设计能力的一门课程。培养学生综合运用所

破碎机产品中心_环球破碎机网 ycrusher

环球破碎机网是中国最大的专业性破碎机网站,收罗全球大量颚式破碎机、圆锥式破碎机、冲击式破碎机、双辊破碎机、塑料破碎机、辊式破碎机、锤式破碎机、复合式破碎机、反击式破碎机、旋回式破碎机、新型破碎机、移动破碎机、破碎机、球磨机、洗砂机、雷蒙磨等产品和采购交易信息。

【全新】破碎机_看最新型号破碎机_问破碎机价格表-中国

2 之 中国路面机械网破碎机整机平台能为破碎机用户提供咨询到破碎机厂家2023 年的报价,也能够查到最新的破碎机型号、破碎机图片、口碑、视频等相关内容。 返回首页 网站导航 用户中心 中国工程机械工业协会筑养路机械分会

钻芯取样机价格-最新钻芯取样机价格、批发报价、价格大全

FQZ-Ⅱ型风动混凝土钻芯取样 混凝土取芯钻机 厂家直销质量保证. 阿里巴巴为您找到100个今日最新的钻芯取样机价格,钻芯取样机批发价格等行情走势,您还可以找市场价格、批发价格等相关产品的价格信息。. 阿里巴巴也提供相关钻芯取样机供应商的简介,主营

纺织粉碎机 RESTAURANT LES GABOUREAUX

2017年11月30日 订货号:22556,类型:复合式破碎机,货号:15555,品牌:晟航宇,型号:HY950,应用领域:家居 纺织 回收行业,纤维切断机、碎布机、布碎机、短切机、玻璃纤维粉碎机,,青州市泰航机械设备主导产品纤维切断机,粉碎机以及其他配套产品得到广大用户认可,应用于

JC系列欧版颚式破碎机-上海山美环保装备股份有限公司

2023年7月24日 JC系列欧版颚式破碎机. JC系列欧版颚式破碎机是在几十年的传统颚式破碎机设计制造经验的基础上,采用有限元分析方法成功开发的新一代产品。. 与传统的颚式破碎机相比,JC系列颚式破碎机在设计和制造方面对细节更为重视,采用高强度材料和制造工

塑料破碎机-塑料破碎机价格、图片、排行 阿里巴巴

还包括价格,高清大图,成交记录,可以选择旺旺在线,如实描述的店铺,支持支付宝付款。找塑料破碎机品牌,上阿里巴巴1688 海量货源 首单包邮 48小时发货 7+包换